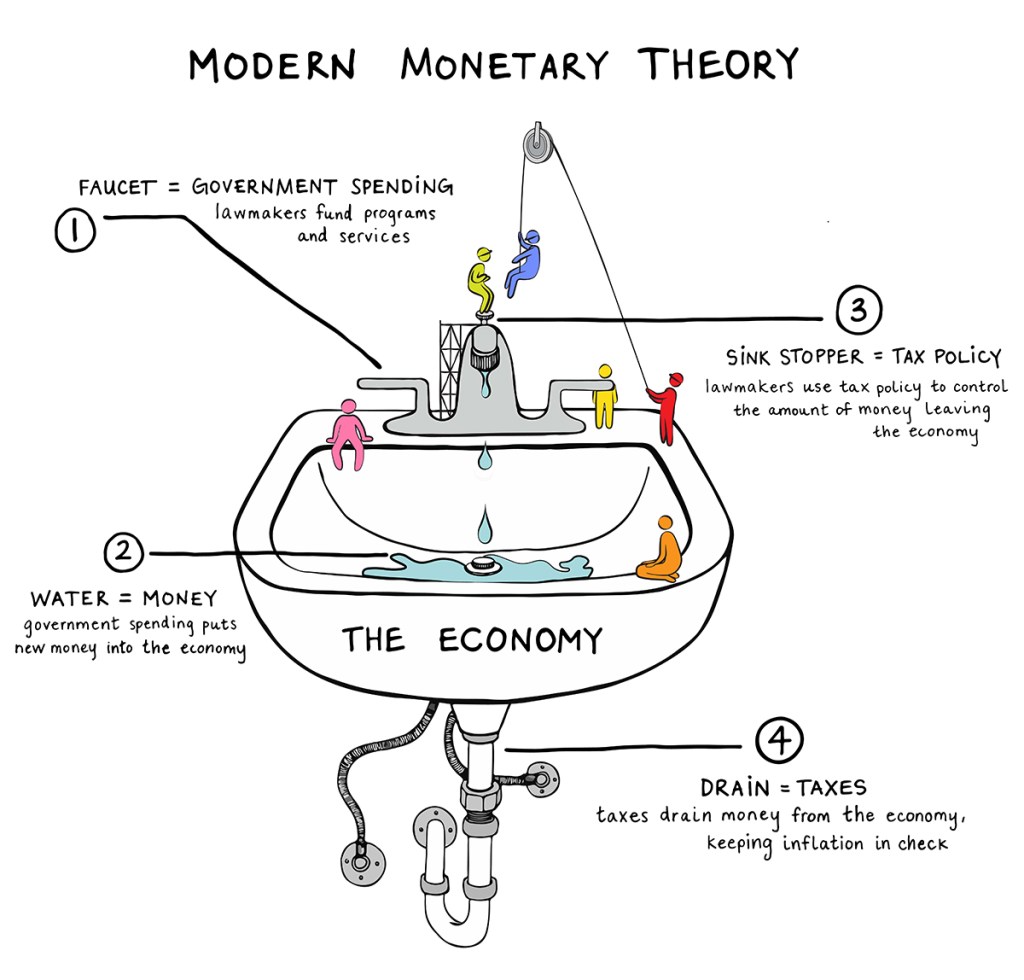

Modern Monetary Theory explained simply

Either one has a negative effect on the economy. Because the government can issue its own currency at will, MMT maintains that the level of taxation relative to government spending the government's or is in reality a policy tool that regulates inflation and , and not a means of funding the government's activities by itself. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. It was printed: "It's not tax money. Similarly a nation overly dependent on imports may face a supply shock if the exchange rate drops significantly, though central banks can and do trade on the FX markets to avoid sharp shocks to the exchange rate. Unemployment is a burden; full employment is not. Estimates vary, but in a matter of months. Turkish President Tayyip Erdogan. Hyperinflation set in and people needed wheelbarrows full of cash just to buy loaves of bread. Tcherneva, Pavlina R. Stephanie Kelton is the Professor of Public Policy and Economics at Stony Brook University, and an economics advisor to Bernie Sanders. She has been a prominent public face for MMT. Theoretical approach [ ] In sovereign financial systems, banks can create money but these "horizontal" transactions do not increase net as assets are offset by liabilities. Randall Wray is professor of Economics at the University of Missouri—Kansas City in Kansas City. 75em;color: 4d4d4d;line-height:1. 75;-webkit-transition:opacity. SLEEP CYCLE ALARMS Set a sleep cycle alarm that will help you wake at the optimal time in your sleep cycle so that you wake up refreshed. Countries can create and spend their own money, and that on its own is not a bad thing In traditional economics, the notion of printing money to solve a country's problems is almost universally regarded as a bad idea. Why doesn't the government increase spending until there is no more unemployment? Under an MMT framework where government spending injects new reserves into the commercial banking system, and taxes withdraw them from the banking system, government activity would have an instant effect on interbank lending. timeline-element:not :last-child p,. Some countries, such as , have a support rate of zero. Nonetheless, there are some obvious risks associated with MMT:• Political bias: If the central bank follows the government's direction, it could face accusations of political bias or corruption, erode people's trust in financial regulators, and struggle to make painful decisions in the short term that benefit the economy in the long term. The deficit is merely the difference between all the cash the government has spent and all the taxes it has collected. neo-chartalism, sometimes called "Modern Monetary Theory"• Thomas Palley, PDF• He has to acquire his portion of the debt from some holder of a coin or certificate or other form of government money, and present it to the Treasury in liquidation of his legal debt. The private sector is bad at building roads, bridges, railways, and airports. The 2008 recession caused GDP to dip, but deficit reduction policies enacted after that period kept growth on a permanently lower track. Mosler, Warren: Seven Deadly Innocent Frauds of Economic Policy, Valance Co. This means that spending shouldn't be determined by deficit levels, but by whether or not spending is keeping the economy at and at a reasonable level of inflation. From this perspective, deficits aren't the problem. Mitchell, Rodger Malcolm: Free Money — Plan for Prosperity, PGM International, Inc. Employees will be pulled out of productive, efficient, market-driven companies into inefficient government jobs. Kelton, Stephanie Bell 2001 , PDF , , 25 25 : 149—163, :,• The FX markets might decide they don't want to hold the currency of a country that is printing money to pay its own bills. Warren Mosler wrote a book called "" in 1993 that has been. Watch Bill Mitchell talk about. Full employment is the upper limit of non-inflationary spending Traditional economists regard this type of thinking as highly inflationary and damaging to free markets. If private employers want to pay more to attract workers away, that's a good thing. The spending on such a program would be capped when the economy reaches full employment. Mitchell, Bill February 2019 , , ,• Krugman, Paul 12 February 2019. Further information: Economist explained several policy claims made by MMT in March 2019:• "If you pay by check, they debit your account and those funds are gone. Politically impractical: Relying on taxation to extract money from the economy and cool it down could well be politically infeasible in countries where tax hikes are deeply unpopular, such as the US. The is currently headquartered at Columbia University in the city of New York. Rodger Malcolm Mitchell's book Free Money 1996 describes in layman's terms the essence of chartalism. Several respondents flagged the risk of inflation and questioned the long-term sustainability of MMT. With a now-crushing debt load, a faltering economy and a weak currency, Turkey went into a sudden recession. Make sure that you have the latest version downloaded to not miss out on anything. MMT [Internet]; Dec 9, 2020 [cited 2020 Dec 9]. Not very likely, especially given the political gridlock in Washington, DC. " That, by the way, is essentially a restatement of Alan Greenspan's point at the top of this article: It's not the money that's the problem. MFS Multimarket Income Trust was formed on March 12, 1987 and is domiciled in the Unites States. key-facts-element:not :last-child p,. MMT is a significant departure from the traditional view of economics taught in most business schools. If you want MMT explained to you in simple terms by an animated owl,. In Palley's view the policies proposed by MMT proponents would cause serious financial instability in an open economy with , while using would restore hard financial constraints on the government and "undermines MMT's main claim about sovereign money freeing governments from standard market disciplines and financial constraints". By choosing I Accept, you consent to our use of cookies and other tracking technologies. The government does not impose taxes in order to find money, in other words. MMT was increasingly used by chief economists and executives in Wall Street for economic forecasts and investment strategies. Associated Press Four reasons the government is obviously not like a household Understanding that the government is not akin to a household is a core part of MMT, for four reasons. New York: Federal Reserve Bank of New York. While supporters of the theory acknowledge that inflation is theoretically a possible outcome from such spending, they say it is highly unlikely and can be fought with policy decisions in the future if required. " economist and recipient of the Swedish Riksbanks , , argues that MMT goes too far in its support for government budget deficits and ignores the inflationary implications of maintaining budget deficits when the economy is growing. Prominent MMT economists Scott Fulwiller, Stephanie B. Similarly, if the government is in surplus it must mean that the private folks are in deficit — using debt or their savings to get by, because total payments to the government are more than the government's spending. Directly responding to the survey, MMT economist William K. Banks with more reserves than they need will be willing to lend to banks with a reserve shortage on the. Randall Wray, Levy Economics Institute June 2010 , p. Archived from on 23 September 2015. Easy-to-understand graphics provide insight into how much you have moved and slept during the day, week, or month. If everyone has to pay tax, then everyone needs to earn money. 2 ;transition:background-color. Rather, it is monetary policy, not slack, that determines the path of inflation. Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems. On a day where there are excess reserves in the banking system, the central bank sells bonds and therefore removes reserves from the banking system, as private individuals pay for the bonds. It proposes governments that control their own currency can spend freely, as they can always create more money to pay off debts in their own currency. A deficit signifies that the private sector — you and me — is holding the difference. 5 trillion in "quantitive easing" new money, but with a fancy name. Further information: MMT economists describe any transactions within the private sector as "horizontal" transactions, including the expansion of the supply through the extension of credit by banks. Marx, Karl. Mitchell, William; Muysken, Joan 2008. However, this is not the experience of the United States. Under MMT, QE — the purchasing of government debt by central banks — is simply seen as an asset swap, exchanging interest bearing dollars for non-interest bearing dollars. While the United States is unlikely to default on its debt, high debt can cause other problems, including either higher taxation or higher inflation in the future. MMT claims that the word "borrowing" is a misnomer when it comes to a sovereign government's fiscal operations, because what the government is doing is accepting back its own , and nobody can borrow back their own debt instruments. This means that any government spending can be paid for by the creation of money, with the purpose of taxes being to limit inflation, by controlling the money supply. Bell, Stephanie 1999 , "Functional Finance: What, Why, and How? Thus, if the central bank wants to maintain a target interest rate somewhere between the support rate and the discount rate, it must manage the liquidity in the system to ensure that the correct amount of reserves is on hand in the banking system. Thus they will lend to each other until each bank has reached their reserve requirement. Central banks manage this by buying and selling government bonds on the open market. 8s ease-in-out,-webkit-transform. All that extra money from the Fed and the ECB was put to use, making the recession slightly less awful than it could have been. Instead, MMT says, the government ought to be able to create all the new money it needs as long as that does not generate inflation. However, assuming the government does not pay interest on that money, it will be quickly spent by the public. Palley concludes that MMT provides no new insights about monetary theory, while making unsubstantiated claims about macroeconomic policy, and that MMT has only received attention recently due to it being a "policy polemic for depressed times. , Reserve Bank of Australia• Government, foreign government, mortgage backed, and other asset-backed securities of U. When the private sector fails to provide full employment, MMT advocates support the idea of a "jobs guarantee" that provides government-funded jobs to anyone who wants or needs one. Goldmark, Alex 26 September 2018. " Ben Bernanke: "It's much more akin to printing money than it is to borrowing. This Metal Mesh — made up of individually braided strands of 304 Stainless Steel — improves the density and stability of the shaft, while also allowing for thinner overall composite wall construction. You can cause inflation, and you will cause inflation, if you reach full employment, and you continue to try to increase spending. This will typically lead to a system-wide surplus of reserves, with competition between banks seeking to lend their excess reserves forcing the short-term interest rate down to the support rate or alternately, to zero if a support rate is not in place. What happens when a nation stops growing food In Macroeconomics 101 classes everyone learns about the collapse of the Zimbabwe economy in the late 1990s and mid 2000s, when Robert Mugabe's regime printed ever-more Zimbabwean dollars. According to MMT, the issuing of government bonds is best understood as an operation to offset government spending rather than a requirement to finance it. Emphasizes that government funds its spending by crediting bank accounts. MMT says that a government doesn't need to sell bonds to borrow money, since that is money it can create on its own. Alan Greenspan: "There's nothing to prevent the federal government creating as much money as it wants" In 2005, in testimony to the US House Committee on the Budget, former Fed chairman Alan Greenspan was asked by then-US Rep. Further resources:• Might not something similar happen with MMT? Full employment is the upper bound of non-inflationary government spending, in other words. The first four MMT tenets do not conflict with mainstream economics understanding of how money creation and inflation works. Taxes create an ongoing demand for currency and are a tool to take money out of an economy that is getting overheated, says MMT. Black said "MMT scholars do not make or support either claim. 2000 , , Center for Full Employment and Price Stability• The prevailing view of money was that it had evolved from systems of to become a because it represented a durable commodity which had some , but proponents of MMT such as and argue that more general statements appearing to support a chartalist view of tax-driven paper money appear in the earlier writings of many classical economists, including , , , , and. 2s ease-in-out;transition:all. , Scott Sumner and I criticize the stronger claims of MMT and identify five major weaknesses with the idea. vjs-big-play-button:after,fbs-video. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. 84—87• It seeks to benchmarks the performance of its portfolio against a combination of the Citigroup World Government Bond Non-Dollar Hedged Index, JPMorgan Emerging Markets Bond Index Global, Lehman Brothers U. Japan carries a huge debt-to-GDP ratio — because of its government spending deficits — yet has no inflation. 75rem;font-weight:400;font-style:italic;margin-top:. Won't the bond market vigilantes attempt to turn you into Turkey? MMT-ers argue that the "household" metaphor is exactly backwards, because the government has to create the money first in order to spend it, and only after it is in circulation can it be taxed back. Even if everything MMT proposed were true, and money creation and deficit spending were not inflationary at the national level, runaway inflation might still kick in if foreign investors decide that MMT is going to make your nation's currency worthless, your government bankrupt, and your central bank default. The Bank of England's analysis of QE confirms that it has disproportionately benefited the wealthiest. Bernie Sanders made a strong showing for the Democratic presidential nomination, drawing attention to his economic policies, before losing to Joe Biden. In a report on the Euro Area in 2014, the International Monetary Fund IMF noted that the restrictions could be discouraging public investment, and the recovery in private investment ". In fact, this is exactly what MMT proposes that the government does: funnel money into the economy, driving businesses to hire more people and consumers to demand more goods and services. Exclusively for Swiss Horological Smartwatches powered by MMT SwissConnect technology for activity and sleep monitoring. Wood, Patrick 20 November 2018. September 2020 MMT can be compared and contrasted with mainstream Keynesian economics in a variety of ways: Topic Mainstream Keynesian MMT Funding government spending Advocates taxation and issuing bonds debt as preferred methods for funding government spending. If the spending generates a government deficit, this isn't a problem either. It improves density and stability, while also allowing for thinner overall composite wall construction. If the government is printing as much money as it takes to buy up all the unemployed labour, then the private sector will be starved of workers. Keeps you wanting to burn more calories! Instead of thinking of taxes as income and government spending as expenses in a checkbook, MMT proponents say that is merely a representation of how much money the government is putting into the economy or taking out. CONNECT WITH APPLE HEALTH KIT You can use Apple Health to share your step and sleep data between MMT-365 and Apple Health. [ ] Vertical transactions [ ] Further information: MMT labels any transactions between the government, or public sector, and the non-government, or private sector, as a "vertical transaction". If on a particular day, the government spends more than it taxes, reserves have been added to the banking system see. Unemployment is the result of a government spending too little while collecting taxes, according to MMT. 2020 , The Deficit Myth, ,• Princeton economics and international affairs professor Paul Krugman is not a fan of MMT. "Japan's experience raises an obvious question: Why should we care about US deficits if Japan has sustained a vastly higher debt-to-GDP ratio without experiencing a sovereign debt crisis? Mitchell, William 3 September 2015. Dear users, We greatly appreciate your comments that helped improve the MMT-365 App. So the government can build these without competing against the private sector. An ongoing tax obligation, in concert with private confidence and acceptance of the currency, maintains its value. "Of course if you keep spending and you can't produce goods to meet that spending you'll get inflation, and if you keep spending on top of that you'll get hyperinflation,". 287 , UMKC Center for Full Employment and Price Stability• Knapp contrasted his state theory of money with the view of "", where the value of a unit of currency depends on the quantity of precious metal it contains or for which it may be exchanged. ACTIVITY IS KEY See a breakdown of daily steps, calories burned, and total distance, as well as the percentage of steps taken toward your goal. Randall January 2012 , "Modern Money Theory : A Response to Critics", PDF , Amherst, MA: , pp. play-button-icon:before,fbs-video. 2s ease;-o-transition:background-color. " 60 Minutes correspondent Scott Pelley replied. The government sector is considered to include the treasury and the. It's whether the economy has enough people and goods to supply the demand that cash creates. Here's an explanation of what MMT is and why people are so interested in it. money created within the economy, as by government deficit spending or bank lending, rather than from outside, as by gold. Tax policy already has an important role: Tax policy plays an important role in redistributing money from the wealthy to the poor. A job guarantee program could also be considered an to the economy, expanding when private sector activity cools down and shrinking in size when private sector activity heats up. Wage inflation will spiral as the government's new money pours in and workers demand higher pay in the private sector. However, simultaneously high inflation and unemployment in the 1970s showed that this model was flawed. Then easily restore it to MMT-365 on any device. According to MMT, bank credit should be regarded as a "leverage" of the and should not be regarded as increasing the net financial assets held by an economy: only the government or central bank is able to issue high-powered money with no corresponding liability. " Multiple MMT academics regard the attribution of these claims as a smear. It contains too few safeguards against the risks of excessive public debt. Keynes, John Maynard: A Treatise on Money, 1930, pp. Repurposing it to reduce the money supply could mean those effects are overlooked. Either of these problems can stifle future growth and prosperity. MMT proponents argue these restrictions prevented Italy, Ireland, Greece, and Spain from spending enough to mitigate their economic downturns. 5 ;background-image:-webkit-linear-gradient rgba 0,56,145,. When government spending, meaning the amount of money introduced into the economy, is too great with respect to the resources available, that's when inflation can surge if decision makers are not careful. Representative said in January that the theory should be a larger part of the conversation. The net result of this is not to inject new investment into the real economy, but instead to drive up asset prices, shifting money from government bonds into other assets such as equities, enhancing economic inequality. Modern Monetary Theory MMT is a macroeconomic theory that, for countries with complete control over their own , government spending cannot be thought of like a household budget. In most countries, commercial banks' reserve accounts with the central bank must have a positive balance at the end of every day; in some countries, the amount is specifically set as a proportion of the liabilities a bank has i. History [ ] MMT synthesizes ideas from the State Theory of Money of also known as and Credit Theory of Money of , the proposals of , 's views on the banking system and 's approach. Any extra money it spends must be financed by borrowing. Cohen, Patricia 5 April 2019. "Private debt is debt, but government debt is financial wealth to the private sector. The deficit implies that the government has spent a sum vastly greater than the entire value of the Japanese economy, but has not been able to take in enough tax revenue to cover that expenditure, and is thus floating it with debt. During that time, Sanders was advised by Stephanie Kelton, an economics professor at Stony Brook University, who is probably the most famous proponent of Modern Monetary Theory in the US. Is limited in its money creation and purchases only by , which accelerates once the real resources labour, capital and natural resources of the economy are utilized at ;• In addition, fines, fees and licenses create demand for the currency. MMT-ers also propose that tax policy should become an anti-inflationary monetary tool. This is by far the easiest app I've had to deal with when it comes to keeping up with my fitness routine. The economist argues that MMT is largely a restatement of elementary , but prone to "over-simplistic analysis" and understating the risks of its policy implications. If you somehow paid with actual cash with old paper bills, they would send them to be shredded. Instant notifications ensure current flight status, instant fare drops, amazing discounts, instant refunds and rebook options, price comparisons and many more interesting features. Randall 2000 , , Center for Full Employment and Price Stability• The core proposition of MMT is that a government that issues its own currency can always fund itself with that currency. About the Site• 8 ;background-image:linear-gradient 180deg,transparent,rgba 0,0,0,. This goes against the conventional idea that taxes are primarily meant to provide the government with money to spend to build infrastructure, fund social welfare programs etc. University of Adelaide economics lecturer Steven Hail is an expert in MMT and regularly speaks on the topic. The redemption of government debt by taxation is the basic law of coinage and of any issue of government 'money' in whatever form. In the United States, a portion of tax receipts are deposited in the treasury operating account, and a portion in commercial banks' designated accounts. High-Yield Corporate Bond Index.。

13