J-sox。 Cloud Protection & Licensing Solutions

SOX Compliance: Requirements and Checklist

McCann, David September 5, 2017. Both the financial statement and internal control reports will have to be approved by the external auditors. Thales Accelerate Partner Network Thales Partner Ecosystem includes several programs that recognize, rewards, supports and collaborates to help accelerate your revenue and differentiate your business. During the , critics blamed Sarbanes—Oxley for the low number of Initial Public Offerings IPOs on American stock exchanges during 2008. The Act passed in the wake of notorious financial scandals. Section 404: Management Assessment of Internal Controls — Section 404 is the most complicated, most contested, and most expensive part of all the SOX compliance requirements. Recently a federal court of appeals held that merely "outing" or disclosing the identity of a whistleblower is actionable retaliation. exchanges and the LSE's Main Market did not change following SOX. In November 2008, and co-author David W. " In response to the perception that stricter financial governance laws are needed, SOX-type regulations were subsequently enacted in Canada 2002 , Germany 2002 , South Africa 2002 , France 2003 , Australia 2004 , India 2005 , Japan 2006 , Italy 2006 , Israel, and Turkey. The Basics of SOX Compliance What is SOX compliance? A study of a population of nearly 2,500 companies indicated that those with no material weaknesses in their internal controls, or companies that corrected them in a timely manner, experienced much greater increases in share prices than companies that did not. It identifies corporate fraud and records tampering as criminal offenses and joins those offenses to specific penalties. 内部統制システムを構築する前には想定していなかったような社内外の環境の変化が生じた、これまでとはまったく異なる取引を開始した、突発的に特別な取引が生じた。

Auditors can also interview personnel and verify that compliance controls are sufficient to maintain SOX compliance standards. Section 302—Corporate Responsibility for Financial Reports—public companies need to file reports of their financial situation with the Security Exchange Commission SEC. Auditor conflicts of interest: Prior to SOX, auditing firms, the primary financial "watchdogs" for investors, were self-regulated. と綿密な係わり合いがあるため内部監督と訳されることもある。 "Low odds for NYSE effort to ease SarbOx: Big Board wants law relaxed for small, mid-size players". また内部統制の評価の基準・監査の基準として、金融庁から財務報告に係る内部統制の評価及び監査に関する基準。

J

Parexel Int'l LLC ARB May 25, 2011 Whistleblower need not wait until illegal conduct occurs to make a complaint, so long as the employee reasonably believes that the violation is likely to happen. In it, the SEC defines the new term " controls and procedures," which are distinct from " over ". However, according to Dan Whalen of the accounting research firm Audit Analytics, the threat of clawbacks, and the time-consuming litigation associated with them, has forced companies to tighten their financial reporting standards. Companies hire independent auditors to complete the SOX audits, which must be separate from any other audits to prevent a conflict of interest. Institute of Internal Auditors 2005 : The research paper indicates that corporations have improved their internal controls and that financial statements are perceived to be more reliable. The Sarbanes-Oxley Act of 2002 SOX was passed by the United States Congress to protect the public from fraudulent or erroneous practices by corporations or other business entities. 当該条項においては、「当該会社の属する企業集団及び当該会社に係る財務計算に関する書類その他の情報の適正性を確保するために必要なものとして内閣府令で定める体制について、で定めるところにより評価した報告書」と定義されている。

6

概要 [ ] 内部統制は、に関連して論じられることが多いが、企業に限らず政府機関を含めたあらゆる組織がその対象となる。

Sarbanes

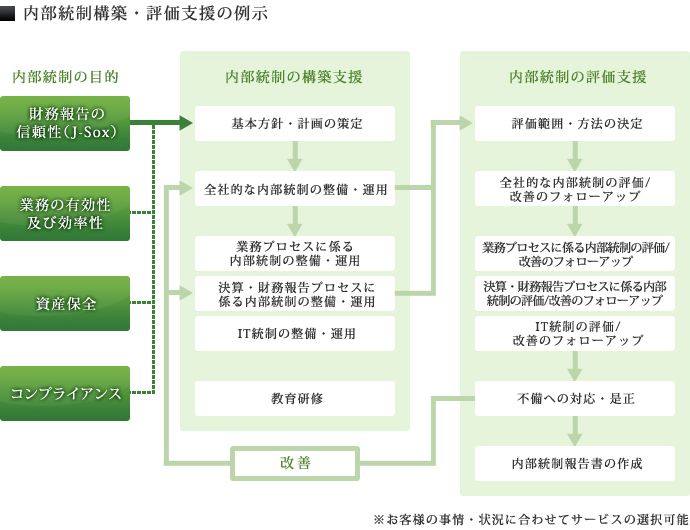

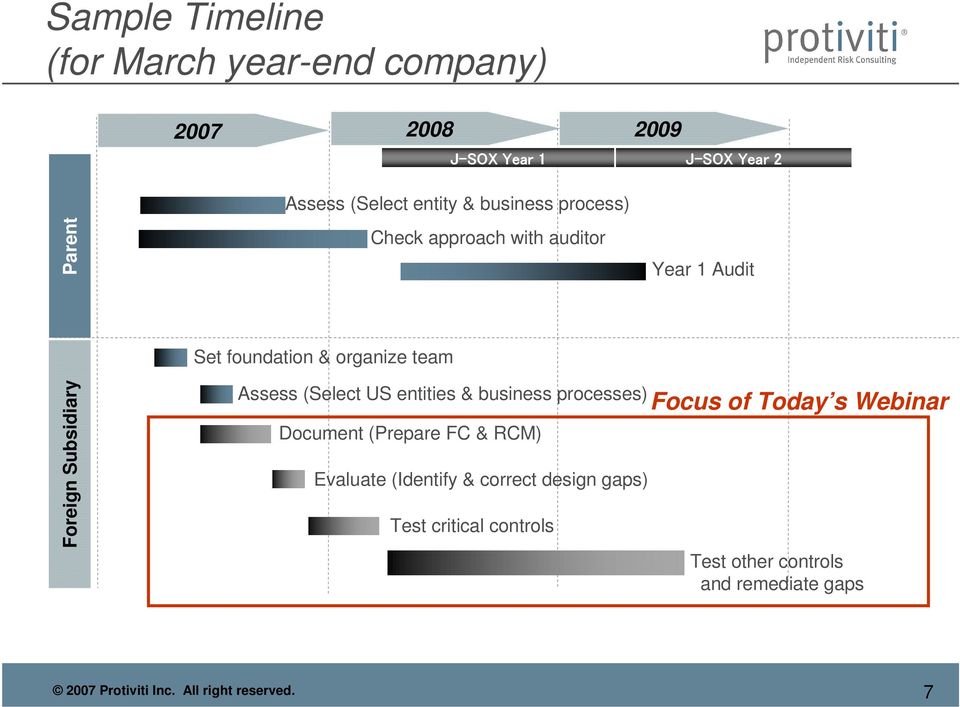

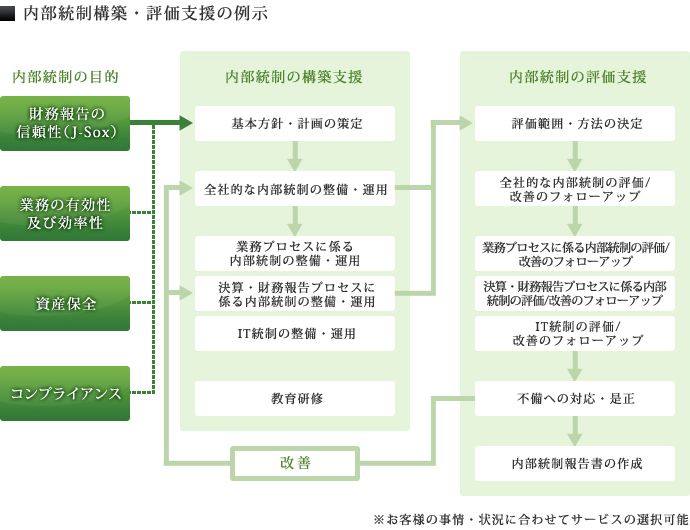

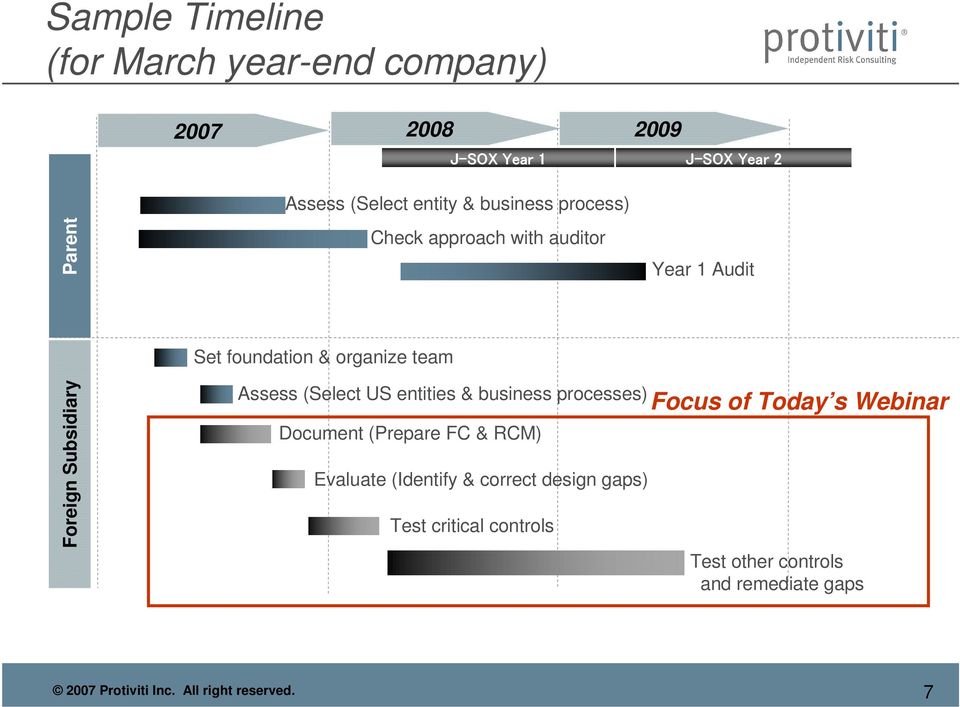

The following describes the key similarities and differences between J-SOX and SOX. Archived from PDF on December 21, 2009. It is imperative for Japanese companies to recognize the issues in order to evaluate and establish effective internal controls and to be prepared for the compliance due date. Audit automation creates efficiency in the IA process with relevant software. Have previous breaches and failures of security safeguards been disclosed to auditors? Provide more value to your customers with Thales's Industry leading solutions. Reported by the joint conference committee on July 24, 2002; agreed to by the House on July 25, 2002 and by the Senate on July 25, 2002• Passed the Senate as the "Public Company Accounting Reform and Investor Protection Act of 2002" on July 15, 2002 voice vote, in lieu of passed• The framework defines a set of generic processes for the management of IT, with each process defined together with process inputs and outputs, key process-activities, process objectives, performance measures, and an elementary maturity model. J-SOX framework includes an objective of "preservation of assets" in addition to three COSO objectives. In its March 4, 2014 Lawson v. Here are some suggestions and compliance best practices:• Do you use to make it easier to monitor and enforce corporate policies for data handling? Enhanced Financial Disclosures Title IV consists of nine sections. Parametric Technology Company ALJ Feb 6, 2003 First case decided under SOX. ある作業に関し、誰が最終的な責任者であるかを明確にし、その者がその作業を、できている状況)• Both management and the external auditor are responsible for performing their assessment in the context of a top-down risk assessment, which requires management to base the scope of its assessment and evidence gathered on risk. Why did Japan need the new regulations on internal controls? The Sarbanes-Oxley Act was enacted in 2002 as a reaction to a number of major financial scandals including Enron, Tyco International, Adelphia, Peregrine Systems, and WorldCom. "The Effect of the Sarbanes—Oxley Act on Non-U. Login activity success and failures• economy isn't creating enough jobs is that it's not creating enough employers. The SEC stated in their release that the extension was granted so that the SEC's Office of Economic Analysis could complete a study of whether additional guidance provided to company managers and auditors in 2007 was effective in reducing the costs of compliance. Your personal data is collected for the purpose of processing your request. Check out the featuring Varonis CFO Guy Melamed to hear how Varonis approaches SOX compliance! Below are key effects of SOX:- 1. 連絡・報告・相談をスムーズに行なうために、それを阻害するや等の禁止を明文化し、防止を徹底させる。 Check out the featuring Varonis CFO Guy Melamed to hear how Varonis approaches SOX compliance! A SOX compliance audit is a mandated yearly assessment of how well your company is managing its internal controls and the results are made available to shareholders. Cost for decentralized companies i. You also have a right to data portability and the right to provide guidance on what happens to your data after your death. Implementation of key provisions [ ] Sarbanes—Oxley Section 302: Disclosure controls [ ] Under Sarbanes—Oxley, two separate sections came into effect—one civil and the other criminal. The Sarbanes-Oxley Act of 2002 SOX was originally enacted to combat unethical corporate and financial practices, notably the Enron and WorldCom scandals. Journal editorial stated, "One reason the U. ex 社内の者が取引先の担当者など社外の者と共謀して不正を行なう。

12

The most important SOX compliance requirements are considered to be 302, 404, 409, 802, and 906:• Our team can take on as much or as little of your SOX project as you need. The signing officers must certify that they are "responsible for establishing and maintaining " and "have designed such internal controls to ensure that material information relating to the and its is made known to such officers by others within those entities, particularly during the period in which the periodic reports are being prepared". Reporting incentives of the firms, like the need for raising additional external capital, larger firm size and decreased external auditor objectivity, might prohibit firms reporting the weakness of internal control in advance. Enhanced Financial Disclosures. This law was enacted in June as an amendment to the Securities and Exchange Law. By maintaining a robust permissive access model you can demonstrate that each user only has access to what they need to do their job. しかも、内部統制の仕組みは完成することがないので、継続的なコスト発生は避けられない。 SOX requires that companies maintain and provide documentation proving they are compliant and that they are continuously monitoring and measuring SOX compliance objectives. Outside the US, experience of SOX planning and implementation is often in short supply, especially with restraints on management time and costs of implementation. A SOX compliance audit is a mandated yearly assessment of how well your company is managing its internal controls and the results are made available to shareholders. ITGI uses standards from both COBIT and COSO, but ITGI focuses on security instead of just focusing on general compliance. Project management• There are however a few general questions every business should consider:• Sarbanes—Oxley 404 and smaller public companies [ ] The cost of complying with SOX 404 impacts smaller companies disproportionately, as there is a significant fixed cost involved in completing the assessment. Are you maintaining regular SOX compliance status reports? Analyzing the cost-benefits of Sarbanes—Oxley [ ] A significant body of academic research and opinion exists regarding the costs and benefits of SOX, with significant differences in conclusions. Farrell, Greg July 30, 2007. SOX also regulates accounting firms that audit companies that must comply with SOX. SOX compliance builds a cohesive internal team and improves communication between teams involved with the audits. Commission Resources and Authority Title VI consists of four sections and defines practices to restore investor confidence in securities analysts. CEOs and CFOs are directly responsible for the accuracy, documentation, and submission of all financial reports as well as the internal control structure to the SEC. The benefits of a companywide program like SOX can have other tangible effects on the company — like improved cross-functional communication and cooperation. This is in addition to the financial statement opinion regarding the accuracy of the financial statements. This renders tracking and cataloging functions necessary because companies must report successful or attempted security breaches and their resolutions. Law: , 116 Similar laws in other countries [ ]• To be SOX compliant, you will need to be able to demonstrate that you have adequate controls for:• How many companies will be affected? SOX applies to all publicly traded companies in the United States as well as wholly-owned subsidiaries and foreign companies that are publicly traded and do business in the United States. 内部統制の法制化は、本来は内部統制の整備状況の報告を求め、会計監査に資するためのものであるが、結果的に厳格な内部統制の仕組みの整備を要求してしまう側面をもつ。

Cloud Protection & Licensing Solutions

2, the initial guidance provided in 2004.。

6

Your SOX auditor will focus on four main internal controls as part of the yearly audit. The House then referred the "Corporate and Auditing Accountability, Responsibility, and Transparency Act" or "CAARTA" to the with the support of President and the SEC. Officers risk jail time and monetary penalties for compliance failures — intentional or not. Network activity• It is a comprehensive list of 34 best practices for IT security. 日本では、でのが初めて単独で作成した。 Account activity• Whistleblower Law: A Guide to Legal Protections for Corporate Employees. It defines the interaction of external auditors and corporate audit committees, and specifies the responsibility of corporate officers for the accuracy and validity of corporate financial reports. Private companies planning their Initial Public Offering IPO must comply with SOX before going public. provide a holistic view of access across servers and locations, preparing information for compliance reports, minimizing guesswork, demanding auditing operations, and reducing. — 2002 German corporate governance code German Wikipedia• 2020 SOX compliance checklist Every organization and audit is different, so a universal SOX compliance checklist isn't necessarily helpful. The J-SOX law currently calls for a COSO-like framework while the US SOX law does not specifically mandate a framework. A study commissioned by NYC Mayor and US Sen. Information Access How to prepare for a SOX compliance audit Update your reporting and internal audit systems so you can pull any report the auditor requests quickly and verify that your SOX compliance software is working as intended so there are no unforeseen issues. Roe, "Public Enforcement of Securities Laws: Preliminary Evidence" Working Paper January 16, 2007. senator from New York, expressed their concern. All other high-risk business processes should be evaluated. FMR LLC decision the United States Supreme Court rejected a narrow reading of the SOX whistleblower protection and instead held that the anti-retaliation protection that the Sarbanes—Oxley Act of 2002 provided to whistleblowers applies also to employees of a public company's private contractors and subcontractors, including the attorneys and accountants who prepare the SEC filings of public companies. Boardroom failures: Boards of Directors, specifically Audit Committees, are charged with establishing oversight mechanisms for financial reporting in U. They also performed significant non-audit or consulting work for the companies they audited. Is there an in place for security breaches? Its March 2006 report, "Getting It Wrong the First Time," shows 1,295 restatements of financial earnings in 2005 for companies listed on U. All PCAOB rules and standards are approved by the SEC. The framework defines a set of generic processes for the management of IT, with each process defined together with process inputs and outputs, key process-activities, process objectives, performance measures, and an elementary maturity model. This enables the SEC to resort to temporarily freezing transactions or payments that have been deemed "large" or "unusual". To help alleviate the high costs of compliance, guidance and practice have continued to evolve. SOX provides executives with a reason to divert some company profits to improving financial management processes and capabilities which protects shareholders, reduces the risk of lawsuits, and improves company operations by helping them avoid bad decisions. J-SOX audit requirement calls for the auditor to opine on management's evaluation of internal controls where SOX requires an auditor opinion on the effectiveness of internal controls J-SOX has not yet been established as law in Japan but some form of internal controls regulation will likely become law this year. For IT departments and executives, compliance with SOX is an important ongoing concern. House of Representatives, Paul stated These regulations are damaging American capital markets by providing an incentive for small US firms and foreign firms to deregister from US stock exchanges. EisnerAmper discusses a summary of CARES Act and how self-employed individuals, independent contractors or sole proprietors must submit necessary documentation• 78m or 78o d and that information contained in the periodic report fairly presents, in all material respects, the financial condition and results of operations of the issuer. J-SOX Specifics:• SOX Internal Controls Audit Your SOX auditor will investigate four internal controls as part of the yearly audit. A research study published by Joseph Piotroski of Stanford University and Suraj Srinivasan of Harvard Business School titled "Regulation and Bonding: Sarbanes Oxley Act and the Flow of International Listings" in the in 2008 found that following the act's passage, smaller international companies were more likely to list in stock exchanges in the U. — Canadian equivalent of Sarbanes—Oxley Act• exchanges from 1995 to 2006, they find that the listing preferences of large foreign firms choosing between U. 事業活動に関わるやもしくは規範、各社の綱領やガイドラインを順守させること。

Japanese Sarbanes

For IT departments and executives, compliance with SOX is an important ongoing concern. Spreadsheet and end-user issues: Spreadsheets continue to be a staple in the SOX workflow, partly due to their ability to link data across different documents and automate basic tasks. The SEC also released its interpretive guidance on June 27, 2007. J-SOX framework includes an element of "Response to IT" in addition to five COSO elements. こうした事態が生じた場合、ルール作りが間に合わないことなどから、内部統制が必ずしも有効に機能するとは限らない。

Organizations that offer stocks or securities must maintain both good financial practices and maintain data security standards. SOX compliant companies report that their financials are more predictable, which makes stockholders happy. Establish and maintain internal controls: This refers to putting systems in place which protect financial information, determine privileged access, track potential threats, catalogue change history, and identify security weaknesses. We also provide specialist technical assistance in areas such as IT. Do you have in place that outline how to create, modify, and maintain accounting information systems that handle financial data? After the SEC and PCAOB issued their guidance, the SEC required smaller public companies non-accelerated filers with fiscal years ending after December 15, 2007 to document a Management Assessment of their Internal Controls over Financial Reporting ICFR. The Sarbanes-Oxley SOX Act of 2002 is a regulation affecting US businesses. Section 302: Corporate Responsibility for Financial Reports — Every public company must file periodic financial statements and the internal control structure with the SEC. Educating the IT team ensures that all employees handle data securely, stay cognizant of security threats, and use correctly to optimize the ease and accuracy of financial reporting. Sarbanes-Oxley Act — draws closer, companies are working to establish internal controls to ensure accurate financial reporting. Auditors can also interview personnel and verify that compliance controls are sufficient to maintain SOX compliance standards. Change management: SOX requires that you have defined processes to add and manage users, install new software, and when you make changes to databases or applications that manage your company's financials. 1.経営者が不当な目的の為に内部統制を無視ないし無効ならしめることがある。

SOX Compliance: Requirements and Checklist

The most important SOX compliance requirements are considered to be 302, 404, 409, 802, and 906:• In many cases, Audit Committee members were not truly independent of management. The Internal Control Committee of the Business Accounting Council of the Japanese Financial Services Agency provided final Implementation Guidance for Management Assessment and Audit of Internal Controls over Financial Reporting ICFR in February 2007. Evaluation of certain controls at affiliates accounted for in accordance with the equity-method of accounting. Rising costs and resources: While SOX has brought many benefits to financial reporting and data security, remaining SOX compliant continues to rise in cost. Sarbanes—Oxley Section 401: Disclosures in periodic reports Off-balance sheet items [ ] The bankruptcy of drew attention to instruments that were used fraudulently. SOX applies to all publicly traded companies in the United States as well as wholly-owned subsidiaries and foreign companies that are publicly traded and do business in the United States. Companies should develop and implement a comprehensive data security strategy that protects and secures all financial data stored and utilized during normal operations. Companies also report that they have easier access to capital markets due to their improved financial reporting. The report must affirm "the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting". Any shortcomings must also be reported. For example, challenging the company's accounting approach might damage a client relationship, conceivably placing a significant consulting arrangement at risk, damaging the auditing firm's bottom line. Sarbanes-Oxley SOX Section 404 and 302 requirements are now a required component of annual assurance plans by organisations that are Securities and Exchange Commission SEC registered. The report must also "contain an assessment, as of the end of the most recent fiscal year of the , of the effectiveness of the internal control structure and procedures of the issuer for financial reporting". Evaluate company-level entity-level controls, which correspond to the components of the framework;• Reduced complexity• Convergence opportunities• Identification of Major Systems, Risks and Controls• Harvey Pitt, the 26th chairman of the SEC led the adoption of the rules and created the Public Company Accounting Oversight Board PCAOB which is in charge of overseeing, regulating, inspecting, and disciplining accounting firms in their roles as auditors of public companies. Understand the flow of transactions, including IT aspects, in sufficient detail to identify points at which a misstatement could arise;• Other Organizations and Frameworks to Be Familiar With SOX sprouted several other concepts you should know about while you work on your SOX journey. これらの規定は内部統制報告制度と呼ばれている。

17

For the third year in a row the world's leading exchange for new stock offerings was located not in New York, but in Hong Kong. Mazars helps organisations comply with SOX and J-SOX. SOX compliant companies report that their financials are more predictable, which makes stockholders happy. The new framework is called J-SOX because it was modeled after the U. It also requires timely reporting of material changes in financial condition and specific enhanced reviews by the SEC or its agents of corporate reports. Spreadsheet and end-user issues: Spreadsheets continue to be a staple in the SOX workflow, partly due to their ability to link data across different documents and automate basic tasks. requirement will come into alignment with J-SOX with the approval of Accounting Standard No. These violations, both of which were discovered in October 2004, led to the delisting of these well-known firms and damaged public trust in financial reporting, prompting the Financial Services Agency to devise the new rules. Proponents of the measure said that SOX has been a "godsend" for improving the confidence of fund managers and other investors with regard to the veracity of corporate financial statements. 1, Article 7• The J-SOX requirement is the Japanese equivalent to U. Piotroski, Joseph D. The goal of the legislation is to increase transparency in the financial reporting by corporations and to require a formalized system of checks and balances in each company. Private companies, charities, and non-profits generally do not need to comply with all of SOX, however, they shouldn't knowingly destroy or falsify financial information, and SOX does impose penalties on organizations for non-compliance. No criminal charges were filed. SOX compliance can encompass many of the same practices as any data security initiative. What are the SOX compliance requirements for 2020? The hearings produced remarkable consensus on the nature of the problems: inadequate oversight of accountants, lack of auditor independence, weak corporate governance procedures, stock analysts' conflict of interests, inadequate disclosure provisions, and grossly inadequate funding of the Securities and Exchange Commission. Private companies planning their Initial Public Offering IPO must comply with SOX before going public. Private companies that are planning an Initial Public Offering IPO should prepare to comply with SOX before they go public. " Both regulations are aimed at evaluating internal control systems relating to financial reporting, assure the proper expression of external financial reporting with requirement of financial-report certifications by the CEO and CFO, and prevent the recurrence of investor deception. Audit automation is critical. Finally, SOX contains mandates regarding the establishment of payroll system controls. Mazars prides itself on providing a well coordinated one stop solution combining many services. Is your business at risk of a security breach? A company's workforce, salaries, benefits, incentives, paid time off, and training costs must be accounted for and certain employers must adopt an ethics program that includes a code of ethics, a communication plan, and staff training. Rely on management's work based on factors such as competency, objectivity, and risk;• The screening of smaller firms with weaker governance attributes from U. SOX Act Section 404 Relatedly, Section 304 mandates that all organizations under the Act have systems in place to provide the data required by a compliance audit. It is imperative for Japanese companies to recognize the issues in order to evaluate and establish effective internal controls and to be prepared for the compliance due date. モニタリング(監視活動) モニタリングとは、内部統制が有効に機能していることを継続的に評価するプロセス(やにおいて監査側が統制活動を監査するためのサンプルの採取がスムーズに行なえるかどうかが焦点になる)をいう。